Online banking has innovated dramatically in an era where the whole world has shrunk to mobile devices. It makes transactions and paying bills more accessible and more secure by providing all the nitty-gritty details in just a single click.

This guide will take you through everything you need about e-banking and building a mobile banking app.

What is Online Banking?

Online banking means dealing with your ledgers through a PC or cell phone. This incorporates moving assets, keeping checks, and covering bills electronically.

Conventional banks and trade union branches regularly let clients access their records through the web. For that reason, online banks and suppliers offer principally mobile access. You won’t meet an accountant eye to eye, however, with a cell phone or PC, you can arrive at your record whenever.

Read More About: Benefits of Using and Making a Dating App

Why are mobile applications gaining importance in the banking sector?

The digitization of banks has, on a fundamental level, impacted how we deal with our monetary exchanges in private and expert conditions.

Otherwise called online banking, web-based financial institutions are worked with through portable mobile banking applications downloaded from your gadget’s application store or the bank’s site.

You can play out similar activities as you would at an actual bank office, including:

- View bank account data and bank proclamations

- View current record balance

- Move cash to inside or outer ledgers

- Cover bills, oversee direct charges

- Send cash universally

- Store checks

For the individuals who travel as often as possible or live abroad, there are particular online banks with benefits like worldwide adaptability, no charges on cash change or ATM withdrawals, and day-in and day-out web-based client care.

Like conventional banks, most American internet-based banks offer FDIC-protected financial and banking institutions and investment in bank accounts, some with impetuses like higher loan fees.

It’s as yet critical to rehearse standard security insurances while utilizing internet banking administrations to forestall phishing, misleading, and misrepresentation. Keep your secret key hidden and abstain from signing into portable mobile apps over open wi-fi association since delicate individual subtleties are defenseless against robbery when gotten to through an unreliable organization.

Notwithstanding actual charge cards and Visas, many banks also offer virtual cards created online for one-time or repeated use. With an extraordinary Mastercard number for each exchange, you can make buys with expanded protection from tricks and false action.

Essential Elements of E-banking

Any E-bank is nonfunctional and incomplete without these three essential elements.

1) ATMs

Many people know that ATMs are a strategy for pulling out and storing cash rapidly and without any problem. ATMs give you the adaptability to pull out money at practically any time. You cannot deny that numerous ATMs will allow you to move subsidies between your records and put aside installments, giving you the fast and straightforward comfort of banking anytime.

2) Direct Deposit

One of the most valuable highlights of electronic banking is immediate storing, which permits you to approve stores and withdrawals from your records. If you are working on a salary basis, your boss might store your checks straightforwardly into your ledger. Essentially, for repeating bills like home loans or protection installments, electronic banking empowers you to pay the vital costs consistently, efficiently, and without missing installments.

3) Debit Card Purchases

In numerous ways, Debit card buys are like Visa exchanges. Electronic banking allows you to make card purchases face to face, on the web, or via telephone. It gives the comfort of a Visa. However, the cash is removed straightforwardly from your connected record, and you can’t spend more than you have.

Read More About: How to Hire dedicated development team?

Benefits of Making a Mobile Banking App

Before diving into mobile banking development, let’s examine the numerous benefits of making a mobile banking app.

1- Extend Your Customers

You can step out and contact a much more extensive crowd with a mobile banking app. An application can cover your corporate clients’ trouble spots and offer an extraordinary fintech answer for your new ones.

Fostering a mobile banking app frees you from relying on the area.

2- Know Your Client

Data can be robust to any business. In a web-based business, getting it is more straightforward. Each client’s activity, like crediting installments/stores, shopping, and voyaging, is recorded and can be utilized to grow new advertising methodologies and promote an expansion in deals.

Accessibility of a mobile banking app opens up additional opportunities concerning client investigation since it’s simpler to work with huge information.

Additionally, data gathered from mobile apps can be utilized for:

- Investigating clients’ way of behaving and making business expectations. For instance, naturally computing a client’s Visa limit given their movement or assessing the volume of new stores one month from now by thinking about your clients’ past information.

- Expanding deals by running indicated and designated crusades. For instance, offering premium cards to dynamic clients.

3- Cut Costs

The plan and execution of mobile banking itself aren’t just modest. Notwithstanding, over the long haul, they’re both more than worthwhile.

By proper, we imply that many costs that happen while maintaining a full-disconnected banking business can be decreased or even eliminated by fostering a mobile banking app.

4- Urge Clients to Utilize Your Administrations

Internet banking applications clients are highly dynamic and devoted because they’re accommodating: be it taxi installment, shopping for food, effective account management, or in a real sense, anything else, it tends to be handily finished with the assistance of a banking arrangement.

Thus, if you foster an easy-to-use mobile banking app, it will urge your clients to utilize your administrations more regularly and not those of banks that don’t have such helpful arrangements, or essentially rather than cash. That implies your income will increase, and you will remain in front of the opposition.

You can consider adding gamification, notwithstanding monetary administrations, to your mobile banking app to develop client experience further

Likewise, it would be brilliant to execute gamification and urge clients to utilize your application benefits much more. That can be:

- Milestones

- Rewards for everyday use.

- Redone profile symbols.

- Competitor lists.

Assemble your computerized image and use it for advertising.

The memorability of a bank is of high significance. Being notable establishes a connection of a reliable help that individuals discuss and utilize. These days, causing you to notice your service is likewise very hard.

That is because today, individuals barely focus on promotions. Many use promotion blockers or simply close advertisements without pursuing or watching them first. Be that as it may, an application is something the vast majority can and will utilize. Hence, making a mobile banking app is one of the best ways to be one bank everyone knows and uses.

Talking about mobile bank development can assist you with drawing in the first customers. The accessibility of well-organized internet banking will make your organization look fresh and innovative. Remember that the accessibility of internet banking applications turns out to be more critical consistently.

Read More About: Webflow vs Shopify. Which Performs Better for Online Business?

Top 3 Things Worth Attention When Creating An Online Mobile Banking App

Now, the benefits of making a mobile banking app are out of the way. Let’s look at a few other factors while building an online mobile banking app.

Easy to Understand Design

A straightforward and easy-to-use plan is one of the most pivotal pieces of beginning a web mobile banking app. An application that is challenging to utilize can be appalling for users. Easy to understand here implies:

- Given route designs that are natural to your clients. All highlights are open with the snap of only two or three buttons.

- Personalization and customization choices (subject tone, modified symbol, and so forth).

Additionally, your application’s exchanges and activities should be speedy and efficient. For example, in Germany, there are still banks that send you sheets with ~30 security codes that clients should enter to confirm each exchange or installment, and, surprisingly, then, at that point, you need to sit tight for one day.

Fundamentally, attempt to adhere to this guideline:

Offer however many types of assistance as you can online at the briefest time conceivable.

Moreover, don’t be excessively nosy with offers and message pop-ups — just advanced customized software offers will assist you with expanding deals and be significant to clients as the application’s proprietor.

Remember that various users utilize different working frameworks. We suggest building an item for Android and iOS to improve your banking application for these significant stages.

However, not just the OS matters. Screen size, telephone highlights (e.g., the user might have a telephone that isn’t streamlined for biometric validation), and so on – you need to think of all these things. Specific individuals may likewise utilize a more established form of the OS, and some might refresh continually.

To upgrade your application for every OS and Contraption aspect. You can:

- Run pre-tests on various gadgets and reenactments. It helps you upgrade the application as well as test security and effortlessness.

- Investigate your application by get-together measurements, running reviews, and getting criticism on client experience.

Various Generations — Different Values

Youthful clients use online banking applications more regularly than their more established peers.

As per Fortune, roughly 30% of customers younger than 54 utilize mobile installment administrations like Venmo and Apple Pay no less than once per week. In comparison, just 12% of those more than 54 do likewise.

This shows that zoomers and recent college grads utilize such applications more frequently than more seasoned ages.

Statista claims that practically half of individuals matured from 18 to 24 utilize online banking applications week after week.

The use of recurrence as well as the qualities are different as well. This age often thinks more about profound association and gamification than their folks and more seasoned family members.

They like to feel and show compassion; they value being focused on, cherished, and engaged, even in such a “serious” application as a financial one.

Read More About: What Are The Major Advantages & Disadvantages of NoSQL?

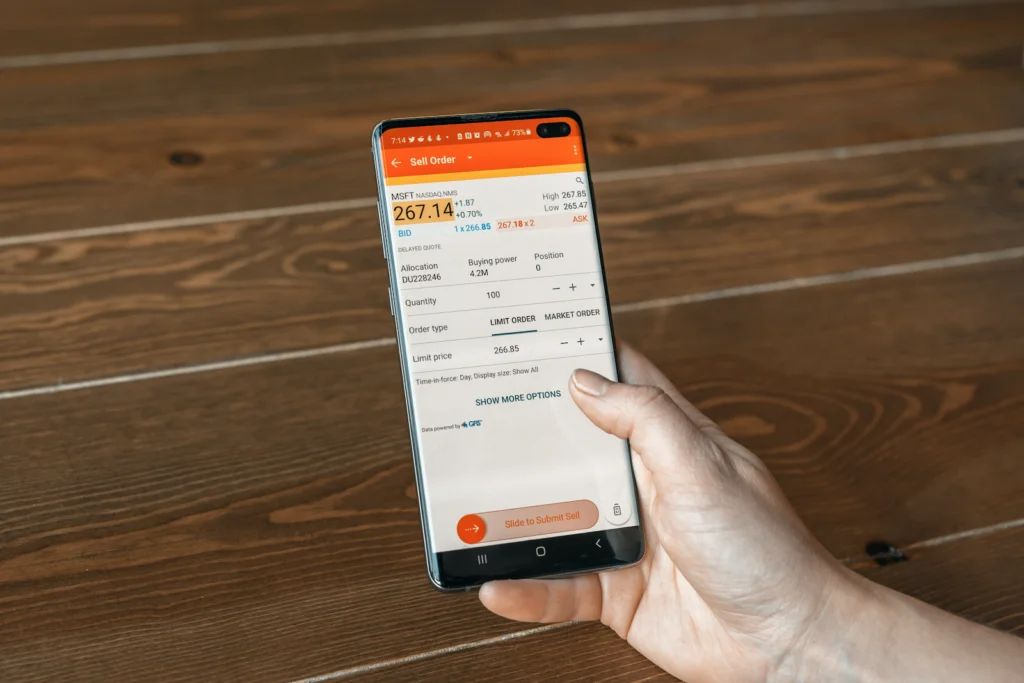

Top Features of an Online Banking App

Now, let’s go through a mobile banking app’s essential and additional elements. In any case, another creativity is generally something worth being thankful for, and if you need to stick out, you could add a few one-of-a-kind highlights to your application.

1- Sign Up and Profiles + Settings

This part is critical for the online banking turn of events. This is where you execute security highlights for confirmation (secret key, biometric checking, additional inquiries, etc.).

While we typically prescribe not to demand excess data at the “Join” stage, here, things are unique. You need to ensure that your clients’ profiles are guarded safely.

So, you need to make sure that the users use complex passwords, accurately connect their telephone numbers, and set individual security questions they will recollect. Also, ensure that they know about your Confidentiality Policy, and acknowledge some other financial terms by making a profile.

Discussing settings is an effective method for making the in-app experience more customized. You can add:

- Turn on/off twofold exchanges.

- Put down a boundary for online installments/credit.

- Add a reserve funds tracker.

- Set an installment update.

2- Home Screen

Fundamentally, the Home Screen is what the customers see just after they sign in. In a banking application, the Home Screen should be as helpful and easy to use as expected. By valuable, we imply that it should contain:

- Balance subtleties. That could be for your client’s primary card or each card independently.

- Wallet. That should be a rundown that gives speedy admittance to each card’s subtleties. You can likewise allow your clients to have various sorts of cards in the event that they need to make an exchange between their cards.

- The rundown of most recent installments and exchanges.

- Speedy admittance to fundamental elements — deposit, exchange. Making an installment and more.

Also, consider adding the home screen element to the mobile application during development.

Plus, your Home Screen could be inconsistent. Users should have the option to pick what’s on their Home Screen. That can be stores, credit installments, protection, gifts, administration installments, etc. — “one size fits all” isn’t and can’t be the situation here.

3- Payments

Many individuals underestimate the “Money transfer” element. Nonetheless, it’s significant and worth consideration.

What’s thrilling about this specific financial activity is that it’s difficult to exaggerate — usually, the more, the better. Aside from the typical exchanges between cards, banks, and records, we suggest adding installments for:

- Stores.

- Banking Services bills.

- Public administrations.

- Advances and credits.

- Fines and duties.

- Travel and public vehicle fees.

- Games.

- Gifts.

Likewise, it wouldn’t be a lot to permit users to set month-to-month/week-by-week installment updates for whatever they could require. It will save their time and lessen the pressure of overlooking repeating installments.

4- Transactions History

Fundamentally, the users can easily track their exchanges and instalments all along their excursion in your web-based banking application.

Also, exchange depiction should be all-around organized and include:

- How much cash has been transferred?

- The beneficiary (either card number or potentially name of individual or organization)

- The date.

- Moreover, you might show the geolocation of where the exchange occurred (if it was a PayPass installment) with an imprint on the guide.

It’s brilliant to channel the costs. Channels can be highly different: by class, by date, how much cash, by objective, etc.

Such a cost administration element can carry extra worth to your clients and further develop the in-app experience.

5- Branches and ATM Map

We bet everyone has encountered disarray due to not having the option to track down an ATM.

We suggest adding this element since you don’t know when your clients might require it. Perhaps they get lost or cannot deal with searching for it: in this way, if a guide isn’t accessible, clients will not have the option to utilize your administration.

You could make your guide stand out and add some gamification highlights. For example, “Pull out cash from the ATM on X Street,” “Take a selfie close to the Y ATM,” and a tweaked symbol for every ATM and branch would be a few extraordinary models.

It’s likewise wise to execute an ongoing counter showing the number of individuals in the line.

6- Support Service

User support is one of the trouble spots of a ton of banks. Intermittently, it’s super ineffectively coordinated; chatbots may not be customized to manage an inquiry somewhat unique to the one on the rundown. To call the client care administration, you must hang tight for quite a while.

Ponder adding a banking chatbot that can assist clients in settling issues with financial balances during your financial programming improvement.

We’re sure that fostering an extraordinary client assistance framework is one of the most incredible ways of turning into that one bank that clients love and will utilize. What’s the significance here? There are a few focuses we need to underline. Client assistance needs to:

Give a chatbot (computerized reasoning modified to deal with straightforward difficulties and answer questions) and live talks.

- Be fast.

- Have a large number of recorded replies to well-known questions and issues.

- Offer day-in and day-out telephone support in instances of crises.

- Give a rundown of contacts/messages/telephone numbers, and so on.

- Offer pre-composed replies to questions that infer “Yes” or “No.”

- Offer help through well-known couriers like Facebook Messenger, Viber, Telegram, and WhatsApp. Clients can be diverted in that general area.

Best Technology Stack for Mobile Banking App Development

1- Front End Stack

The front end is client-side; this is the piece of an application with which clients communicate straightforwardly. Commonly front-end engineers utilize a mix of HTML, CSS, and JavaScript. HTML permits you to structure page components (passages, headings, etc.).

CSS is utilized to style the look and feel of a record using HTML. Also, JavaScript permits you to add elements (activities, intuitive structures, and so on) to the UI. In any case, the arrangement of front-end advancements isn’t restricted to these apparatuses.

2- Back End Stack

The server-side of your application or back-end is liable for the rationale of work, stockpiling, and handling of information. For the improvement of the back-end part, different programming dialects are utilized; among the most well-known in fintech the circle is Java, Kotlin, Python, C ++, C#, and Ruby.

3- Databases

Picking data sets is a significant stage in building the best tech stack for your computerized banking application. The more clients will work with your application, the more prominent the framework is. A data set should deal with these jobs and give quick and proficient handling of client questions. For any activity your clients request balance check, exchange history, or something different, the framework should execute them securely and at high velocity. Databases are meant for that.

Data sets for fintech projects should be solid, which is why banks and other monetary associations favor demonstrated arrangements.

- Native App Development

Native application development is the cycle of creating applications or programming that should be worked on unambiguous gadgets and mobile application stages like Android and iOS. With native application improvement, engineers depend on the local working framework programming language to create applications that fit one specific location.

- Cross-Platform App Development

For the youthful business people who accept cross-platform and hybrid app development as something similar, how about we clear the difficulty in the first case?

Cross-platform vs. hybrid development, both have various implications from one another altogether and assume multiple parts. Cross-platform systems work on the plan to foster shareable and reusable QR code payments for applications for different OS. Composing code once and reusing similar on various stages helps limit improvement expenses and endeavors.

Cross-stage applications will guarantee free execution, vital usefulness, and reasonable creation. In any case, don’t expect superior performance and customization with a cross-platform application advancement structure.

- Hybrid App Development

Hybrid application development is the blend of local and web arrangements where designers need to install the code composed with the dialects like CSS, HTML, and JavaScript into a local application. This can be done with the assistance of modules including Ionic’s Capacitor, Apache Cordova, etc., which empowers to get the entrance of native functionalities.

How to Manage the Security of a Banking App?

Now let’s come to the heart of the matter. How might you make your secure mobile banking app for your customers?

Look at the rundown of safety app features that could prove helpful while making a banking application.

1- Multi-factor Authentication

Making a perplexing secret word is essential yet insufficient in the present reality. To foster a safe banking application, mobile banking app proprietors should utilize multifaceted confirmation to guarantee the information is under a layered guard. If the fraudster breaks one layer, he needs to get through no less than one more, which fundamentally decreases the dangers of being hacked.

Multifaceted confirmation blends at least two independent accreditations:

- Secret phrase.

- Security token.

- Biometric confirmation (fingerprints, face ID, voice acknowledgment, etc.).

- Once a secret word.

- Call confirmation.

- Replies to individual security questions.

2- End-to-end Encryption

Consistently, a huge number of dollars are moved using banking applications. Therefore, mobile banking apps are focal points for programmers.

Start to finish encryption is something that tackles the issue. Fundamentally, start-to-finish encryption (E2EE) is an arrangement of correspondence and exchanges where nobody observing the organization — not programmers, not the public authority, and not the organization that works with your activity — can see the substance and subtleties of the training done.

The most remarkable aspect of E2EE is that it doesn’t need costly innovations, extra preparation, or staff. It’s essentially given by driving installment processors.

3- Device Fingerprinting

Try not to mistake the term for fingerprints as a biometric examination.

Gadget fingerprinting is a method for consolidating various arrangements of signs of a gadget — what working framework it’s based on, program type, screen size, IP address, area, time, language — to recognize it as a great gadget.

In the banking business, it’s utilized for checking whether an individual attempting to enter a record is the individual who’s the proprietor of that record in light of whether they’re utilizing a gadget or program that has been recently used to sign in.

If the gadget doesn’t get perceived, a proprietor receives a warning, an instant message, or an email with caution of an expected misrepresentation or programmer assault.

4- Behavioral Analysis

You could have seen that occasionally you get a warning from an application saying “Dubious movement has been taken note” or something almost identical. That is because you did an activity that has never been done before while utilizing a banking application.

You might see a few similarities between this portrayal and gadget fingerprinting, yet while device fingerprinting tracks the actual gadget, conducting an examination is focused on your activities.

Such an examination is executed in an application using particular programming that screens the login area and online record movement.

Typically, the vitally key highlights required for this examination include:

- Client bank accounts.

- Contact heatmaps.

- Ongoing in-application examination.

5- Real-time Notices

The rundown of mobile banking apps utilizing this element is very lengthy. That shows that it’s nothing remarkable yet undoubtedly important.

The name justifies itself — by giving clients ongoing warnings and cautions (how much cash was spent/installment, “Sign in” notice, utilization of one more gadget notice progressively, and so on), you illuminate your clients about current exercises done in their record.

How To Create A Banking App: Step-By-Step Guide

1- Conceptualize

The main step. Evaluate the expenses early and set clear expectations for the development group to follow. The more granular and unmistakable the way to deal with conveyance is, the less opportunity you will be frustrated or fooled into paying for a perpetual task.

2- Conduct Market Research

After you choose to construct a banking application, you can’t simply bounce right to the turn of events. There are a ton of steps that go before it.

Statistical surveying will assist you with understanding how to make a banking application and effectively convey it to the profoundly cutthroat market.

The principal thought is to investigate the interest and contributions of your future rivals. You want to comprehend what banking applications clients are familiar with, what applications they use, and which highlights those applications are advertising. It will assist you with outlining the excursion and draft plans for the future application.

The best choice you can make is to make an application that is exceptional and doesn’t copy the usefulness of previously existing and well-known arrangements. Developments are one of the ways of ensuring that a business stands apart from the group and offers a few novel highlights.

3- Analyze Target Audience

You want to have a response to the inquiry before you choose how to make an online application.

Attempt to find out as much about your primary interest group as possible. Distinguish their age, area, how they like to invest their free energy, and even how geek they are.

Besides general inquiries, you’ll likewise have to address some banking-explicit questions: the number of exchanges they make each month, regardless of whether they have standard installments, how frequently they reach out to the help administration, etc.

For instance, the younger age between 18 to 24 generally utilizes online banking applications to move modest quantities of cash. A more experienced crowd from 25 to 70 years of age uses such applications to take care of service bills, control income, and make exchanges of more significant sums.

4- Identify & Investigate Competitors

Distinguishing and examining contenders is the following phase of exploration. It will assist you with understanding areas of strength for the frail sides of the opposition, what essential and high-level elements their applications are offering, and what they are proposing to clients concerning administrations.

The gathered data is essential to choosing how to make a financial application. Your objective here is to ensure that your application is superior to that of contenders. While the achievement exceptionally relies upon the highlights, the fundamental belief brings the financial administration you are advertising.

5- Find A Development Company

Finding the right development company is like marriage. If you pick some unacceptable individual, your life might transform into an unending show. So is it for the situation with choosing the suitable monetary programming improvement accomplice for your venture? If you select a temperamental engineer, you will burn through a ton of time, nerves, and cash, and your experience will transform into another Shakespeare’s misfortune. So it requires your investment to find a vendor you can completely trust and depend on.

6- Choose Basic App Features

Each application is interesting. Indeed, even organizations offering similar types of assistance can carry out various uses. The final list of capabilities will rely upon the administrations given, the interest group, the market for which you create an application, etc.

7- Choose Advanced App Features

While essential highlights may be enough for thought testing, you’ll have to add a few extraordinary ones for an undeniable item. This piece of the article audits a portion of the high-level elements that your clients will cherish.

a) Cost Tracking

Users frequently utilize online mobile banking apps to follow their costs. You can add an entire scope of channels, like dividing periods into day to day, week by week, month to month, and yearly. Or again, you can add programmed separating of expenditure by class, e.g., food, installments, wellbeing items, etc.

b) Tedious Mobile Payments

There are a ton of installments that we as a whole do routinely. Adding highlights for dreary installments will save time. This component should incorporate the capacity to set up the term of such installments, for instance, for a couple of months or without an end date. A suggestion to make installments is a pleasant to-have expansion to usefulness.

c) Cashback

Offering cashback is one of the ways of making users hopelessly enamored with your applications. A few banks permit them to pick classifications for which they’ll get installments, like essential food items, cafés, travel, etc.

8- Address Key Challenges Of Mobile Banking App Development

You can learn how to make a banking application from the highlights side. Yet, you will fizzle without tending to a portion of the central points of contention typically connected with improvement for the monetary business.

Specialized Challenges

There are a ton of critical difficulties that designers should consider while choosing how to make a banking application.

Auto-Input – this component should be crippled for mobile apps as it can prompt delicate data being taken by programmers.

Obscure View – when users switch between applications, the screen of a banking application obscures, forestalling individuals around to see delicate data.

In-memory Information Capacity Type – such capacity type permits the storage of data not on a plate of a cell phone but rather in the main memory. It further develops speed reaction time and keeps information from being recovered from a cell phone with an introduced mobile banking app.

9- Build an MVP

A base practical item rendition of your application is a critical stage of the development venture. An MVP barely contains an adequate number of elements and plans to draw in clients, hence assisting you with approving the item market fit and, in general, origination of the application. At this stage, looking for all suitable wellsprings of client feedback is significant.

The more you will gain from your MVP, the better confirmation you will have that your completely evolved application will be a triumph.

10- Get Security in Order

This step requires additional checks from you and the employees dealing with it. Ensure the security highlights needed make it to your application and work impeccably – you can’t think twice about saving money on application security. One significant information break or cash was taken from your clients, and your standing is gone for eternity.

For the engineer, that implies coupling actual security with server-side security, incorporating extraordinary security processes in the onboarding system, performing code muddling, encoding traffic, and adding usefulness like exchange confirmation, biometric ID, PIN change updates, and so on.

11- Design UX and UI

Once the application is developed, now is the ideal time to put a layer of paint on it. The application will have, in some measure, half of its connection point work done right now, yet, you will require a UI originator to make it truly pleasant looking.

The designing stage begins with the making of User Experience (UX). The primary objective of UX is to give a consistent mobile banking client stream. It implies that clients should have the option to travel through application screens without issues. The rationale behind the application should be evident to all clients and not cause disarray.

The UI (UI) upholds the application’s usefulness. It’s the ‘essence’ of your application, and the primary thing clients will see after they open the application.

12- Choose a Technology Stack

You’ll have to settle on the innovation stack to make a banking application. The final tech stack will rely upon the working framework for which you make an application and what highlights you execute.

13- Get the Application Built

Screen the achievements the expectations, and keep your hands on the app development process. This step will take a fair while to finish. The new mobile banking application development will require testing, escalated input, and, most likely, a few other elements.

14- Develop, Test, and Launch the App

After you’ve gathered every one of the prerequisites, distinguished innovations, and elements, the mobile banking application development stage begins. During this stage, the source code of an application is made. Each component is tried to ensure that you send off an application that is completely working, endures high loads, is shielded from hacking assaults, and meets client assumptions.

15- Gather Feedback and Plan for Improvements

After the application has raised a ruckus around town and got its most memorable clients, the business should gather criticism, for example, highlighting its needs, clients’ opinions on the application’s plan, and what shortcomings it has.

16- Maintenance

Presently, you should simply focus on client input, fix anything that annoying bugs advance toward the surface, and guarantee the best client experience conceivable. Preferably, you would have complete documentation on application highlights accessible and usable by your crowd. Help articles, chatbot guidance, and so on – will assist with reducing expenses on Support to have it ahead of time.

How Much Does It Cost To Develop A Banking App?

Banking app development costs can be anything between $100,000-$500,000+ relying upon various variables:

- Application intricacy and carried out highlights

- Number of designated working frameworks

- Tech stack used to make it

- Reevaluating area

- Sort of participation

For instance, employing an in-house development group will build the mobile banking application development cost several times. The expense can sometimes reach $1 million or even go past this number.

Why Are Mobile Applications Gaining Importance in the Banking Sector?

Mobile Banking applications offer greater security and highlights, for example, voice banking, making the customer experience advantageous. Current banking applications are adequately brilliant to help users with every monetary need, for example, market share, credits, bill installments, basic food item installments, and more.

If you want to construct an online banking application, keep in mind that the opposition in the market is high. Be that as it may, with expanding ubiquity of these applications, you can draw in new clients by offering a couple of USPs.

Why Should You Hire Hapy as Your Developer?

Hapy offers the best and most refined app development banking services. We ensure that every demand is met, and we deliver a product worth falling in love with.

We are a digital product agency specializing in designing and developing scalable products for startups. We understand the importance of having a great product and work tirelessly with our clients to ensure their products are practical and easy to use.

Bottom Line

The banking industry should keep steady over the most recent innovations. You can’t overlook how critical a piece of our life is in our cell phones. At this age, you will not have the option to win a client and transform them into faithful clients without offering admittance to your administration from a cell phone.

FAQs

What Are the Main Challenges of Building a Banking App?

The topmost challenge is to meet the security criteria and safeguard user data.

How Long Does It Take To Create a Mobile Banking App?

Building a banking app can take anywhere from 6 to 10 months.

What Are the Latest Mobile Banking Trends?

Contactless ATM and voice recognition.