The SaaS market in KSA is growing fast. Backed by major digital transformation efforts and a push to move government and business operations to the cloud, the Kingdom is building a serious appetite for software solutions.

But for founders, there’s more to it than hype. If you’re considering launching, expanding, or investing in SaaS products in Saudi Arabia, this blog will walk you through everything that matters in 2025 and beyond…from market numbers to real opportunities and things to watch out for.

Why Saudi Arabia Is Becoming a SaaS Hotspot

Saudi Arabia is actively working to reduce its dependence on oil and expand its digital economy. Through Vision 2030, the country is investing heavily in technology, innovation, and digital infrastructure. This shift has created a growing demand for cloud-based software solutions.

Here’s why founders should be paying attention:

-

Government push for digital transformation

-

Increased adoption of cloud and mobile technologies

-

Expanding enterprise and SME sectors

-

Focus on cybersecurity and data sovereignty

-

Surge in demand for remote work tools post-pandemic

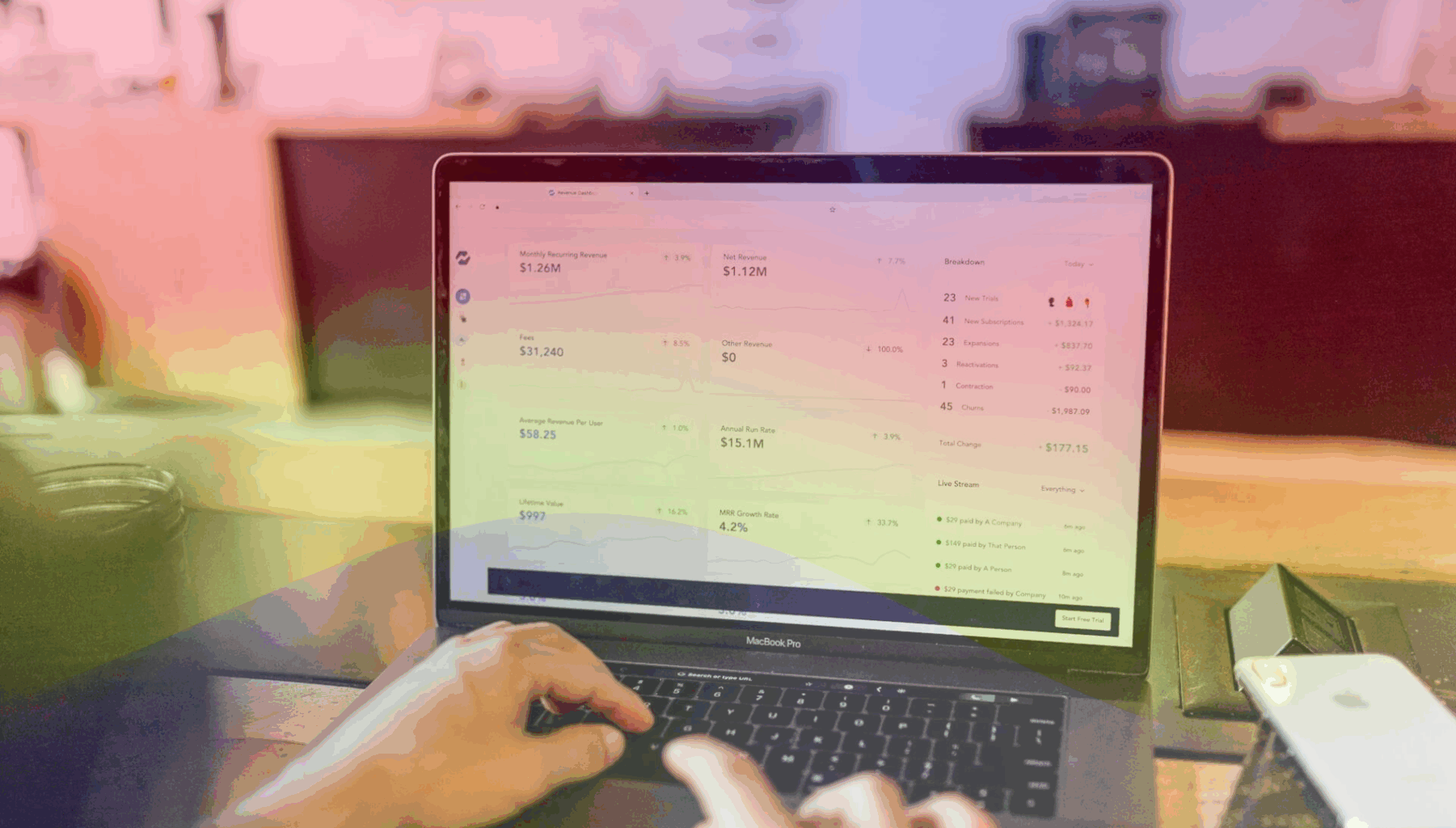

SaaS Market in KSA (Saudi Arabia)

Research shows that the Software as a Service (SaaS) market in Saudi Arabia was valued at approximately USD 427.3 million in 2024. It’s expected to grow to around USD 572.95 million by 2030, with a projected compound annual growth rate (CAGR) of about 5% from 2025 to 2030.

Whether it’s small startups or enterprise clients, demand for scalable, cloud-based software is rising, especially in key sectors like finance, healthcare, and public services.

Key Growth Drivers in the Saudi SaaS Market

1. Vision 2030 & National Digital Transformation

Vision 2030 aims to diversify Saudi Arabia’s economy, and digital transformation is at the core. Initiatives like the Cloud-First Policy (2019) mandate public sector organizations to prioritize cloud adoption, paving the way for SaaS solutions in government, healthcare, and education.

2. Cloud Infrastructure Investment

The government is investing in local data centers, and cloud giants like AWS, Google Cloud, and Microsoft Azure are expanding in the region. This lowers infrastructure barriers for SaaS companies and increases trust from enterprise clients.

3. Digital Adoption Across Industries

Industries such as banking, healthcare, education, and e-commerce are going digital fast. SaaS tools are becoming essential for CRMs, HR systems, inventory management, and financial planning.

4. Shift to Remote & Hybrid Work

Post-COVID work models have changed. Teams need tools that work across locations and devices. Demand for SaaS platforms like Zoom, Slack, Notion, and industry-specific tools has skyrocketed.

5. Increased Government Spending on IT

Public spending on IT and cloud services is growing steadily. Saudi Arabia’s ICT market is projected to hit USD 82.5 billion by 2030. A major slice of this budget is going toward cloud-native and SaaS platforms.

Top Industries Driving SaaS Adoption in KSA

If you’re thinking about entering the market or building something for Saudi Arabia, here are a few high-potential areas:

1. Banking & Financial Services (BFSI)

The demand is high for secure fintech and digital banking platforms. CRM, ERP, HR, loan management and fraud detection SaaS tools are growing in use.

2. Healthcare

Hospitals and clinics are adopting SaaS for patient record systems, telehealth, inventory, and billing. Health tech startups using SaaS models are finding product–market fit.

3. Education

Growth in e-learning platforms, student management systems, and virtual classrooms post-COVID. There is demand from private schools and universities for flexible SaaS tools.

4. Government & Smart Cities

As part of Vision 2030, Saudi Arabia is developing smart cities like NEOM, which will rely heavily on cloud and SaaS solutions for infrastructure, transport, and public services.

4. Retail & E-commerce

With rising online shopping, retailers need tools for inventory, customer service, and marketing automation. SaaS platforms for POS systems and loyalty programs are also gaining traction.

Challenges to Be Aware Of

Like any market, Saudi Arabia’s SaaS ecosystem has its own set of hurdles.

Data Residency & Regulations

Saudi Arabia has strict rules around where data is stored and how it’s handled. Founders must prioritize compliance-first architecture to meet local data and cybersecurity standards.

Vendor Lock-in & Trust Issues

Many enterprises are still wary of putting too much into one platform. Trust-building is essential, especially for newer players in the market.

Talent Gaps

There’s growing demand for SaaS developers and cloud experts, but the local talent pool is still catching up. Founders may need to train teams or partner with existing cloud providers.

What Founders Should Keep in Mind

If you’re planning to build or offer SaaS products in KSA, keep these in mind:

-

Design for Compliance: Respect local laws around data handling and privacy from day one.

-

Think Bilingual: Arabic UX and local payment options are often non-negotiable.

-

Build for Scale: Many clients are looking for flexible, modular tools that integrate well with existing systems.

-

Offer More Than Software: Local buyers value support, training, and onboarding…especially in enterprise and government sectors.

-

Partner Smartly: Align with cloud providers, government programs, or local resellers to boost credibility and reach.

Final Thoughts

The SaaS market in Saudi Arabia is entering a golden period. Backed by strong government policies, increasing cloud maturity, and a digital-first mindset across industries, it’s a space worth watching and building for.

Whether you’re an early-stage founder with a fresh SaaS idea or an established player exploring MENA markets, Saudi Arabia offers a rare mix of growth, scale, and transformation.

At Hapy Co, we work closely with startups and companies building SaaS tools…from MVP to market-ready product. Whether you’re targeting Saudi Arabia or the whole MENA region, our product teams can help you design, build, and scale with speed and clarity.